[ad_1]

Key Takeaways

- Jane Street and Jump Crypto, two outstanding crypto market makers, are scaling back crypto operations

- The choice comes as US regulators proceed an aggressive clampdown on the sector

- Liquidity is already skinny in crypto, and these strikes will solely drop it additional and enhance volatility, writes our Head of Research, Dan Ashmore

It was simply earlier this week that I wrote a piece about establishments abandoning crypto. In the couple of days since, it’s got worse.

Bloomberg reported Tuesday that market makers Jane Street and Jump Trading are decreasing their crypto focus. While not pulling out of the sector utterly, the report acknowledged the duo will likely be market making at a smaller scale than beforehand.

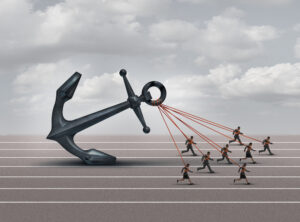

This is a giant blow for crypto markets which had been already displaying skinny liquidity since market making large Alameda evaporated alongside FTX in November. I printed a chunk last week analysing the outflow of stablecoins from exchanges ($22 billion has headed for the exit doorways in 5 months), whereas order e book depth has been alarmingly shallow ever since Sam Baankman-Fried’s celebration tips had been revealed.

That liquidity is about to get even worse. With decrease liquidity comes better volatility, as much less capital is required to maneuver costs. Thus, strikes to each the upside and draw back are exacerbated, one thing I analysed in April when the Bitcoin value, volatility and revenue ranges all reached their highest marks since June 2022.

Investors have to be cautious that, whereas value has been rising the final six months, there has not likely been something constructive popping out of the sector. Quite the alternative, in actual fact – bankruptcies picked up in January amid the continued fallout from FTX, whereas regulators have put the squeeze on since.

More than something, costs have been rising as crypto markets are so strongly correlated with the inventory market and different danger property. As market expectations across the future path of rate of interest rises have peeled back, danger property have rebounded – and which means crypto, too.

With this low liquidity solely getting decrease, the strikes will solely turn out to be extra unstable. As of Friday morning, Bitcoin is buying and selling at $26,200, down 7% within the final 36 hours.

Regulators squeezing the crypto sector

Jane Street and Jump Crypto confronted rising scrutiny as US regulators proceed to clamp down aggressively on the sector. Since FTX collapsed in November, the regauyltory atmosphere has turn out to be way more hostile to the crypto business.

Ironically, Sam Bankman-Fried labored at Jane Street earlier than founding Alameda in 2017. Caroline Ellison, former CEO of Alameda who has reportedly turned on Bankman-Fried forward of his trial, additionally labored at Jane Street earlier than becoming a member of Alameda.

Jane Street was amongst three US buying and selling companies cited by the Commodity Futures Trading Commission lawsuit towards Binance as examples of how US companies might entry the platform regardless of Binance claiming to ban them.

Jump Street was a big backer of Terra, the agency behind the TerraUSD stablecoin and sister coin LUNA, which spiralled to zero in May 2022. The agency was questioned by US prosecutors in an investigation after its demise.

The clampdown has been controversial, with crypto-native companies decrying that exercise might want to transfer off offshore. Coinbase CEO Brian Armstrong has been among the many most high-profile voices to relay this sentiment, saying this week that Coinbase would think about the UAE as a world base, as the US continues to show the screw.

The change was just lately served with a Wells discover from the SEC, a warning of impending authorized motion, most definitely in relation to a violation of securities legal guidelines.

“Crypto and Web3 serve as enormous opportunities for economic and technological diversification for the UAE, and the region has the potential to be a strategic hub for Coinbase, amplifying our efforts across the world”, Coinbase stated in a weblog publish.

On the opposite hand, some are praising what they consider is a protracted overdue squeeze on a sector constructed upon nothing however greed, that has introduced bone-crushing losses for a lot of retail traders over the previous yr. Whatever your view, it’s clear that the US is creating an more and more hostile atmosphere for any agency working within the crypto house.

What subsequent for crypto?

Right now, crypto appears primed to maneuver past the US, via no selection of its personal. While the business can proceed, this nonetheless constitutes a large blow. So a lot of the steep trajectory of crypto throughout the pandemic was primarily based upon the thought that establishments and conventional finance would inevitably pour into the sector. Today, it’s going the alternative approach.

The US is the financial and monetary centre of the world. Crypto companies being compelled out of this market received’t fully forestall on a regular basis folks from investing within the business, however it actually will make it harder and fewer handy. It may also restrict innovation within the sector. This is all bearish for the sector and can undoubtedly inhibit its development going ahead.

As for the value results, Jane Street and Jump Crypto’s choice to pull back hurts the business in a spot it was already struggling – liquidity. The volatility within the sector actually received’t be going away anytime quickly, subsequently, however quite solely rising.

[ad_2]

Source link