[ad_1]

Ethereum value has strengthened its bullish outlook mid-through the week’s buying and selling. The 4.8% achieve in 24 hours coincides with a market-wide restoration led by the most prominent crypto, Bitcoin. BTC surged by greater than 7%, breaching $29,000 resistance within the wake of final week’s sell-off beneath $25,000.

The largest good contacts token, at the moment buying and selling at $1,815, is on the verge of validating a spike above $2,000 for the primary time since early May.

Crypto markets are flipping considerably bullish this week as traders rethink the potential short-term positive factors that may be tapped following the Federal Reserve choice on rates of interest.

The regulator paused rate of interest hikes, a transfer that’s anticipated to bolster threat belongings like Bitcoin and Ethereum. Additionally, Blackrock’s spot Bitcoin ETF application has continued to buoy the crypto market.

As reported this week, extra institutional traders are coming into the crypto market with totally different merchandise. For occasion, Fidelity Investments backed EDX Markets launched on Tuesday.

It is a crypto change platform catering to the wants of brokers and traders who hope to keep away from messy enterprise operations equivalent to people who led to the implosion of FTX.

Ethereum Price Upholds Bullish Outlook as Buy Signals Flash

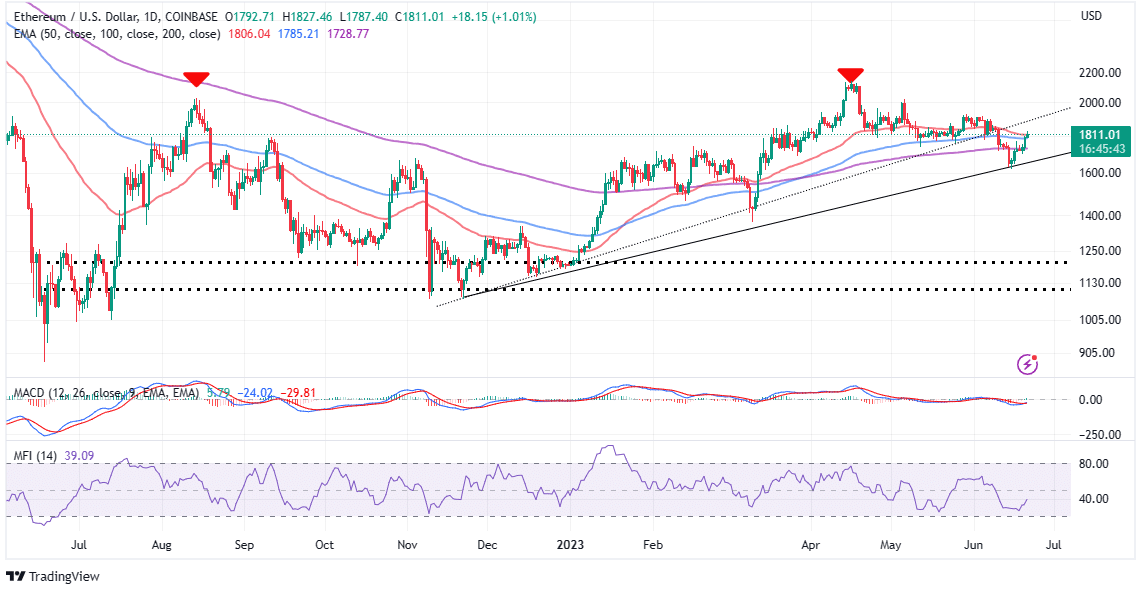

Ethereum value now sits above the utilized transferring averages, beginning with the 200-day Exponential Moving Average (EMA) at $1,728, the 100-day EMA at $1,785, and the 50-day EMA at $1,806.

The bullish outlook, which began to type instantly after the newest dip to $1,625, is now a heartbeat away from closing the hole to $2,000. Meanwhile, a purchase sign from the Moving Average Convergence Divergence (MACD) indicator, is able to bolster the anticipated transfer above $2,000.

Based on the place of the Money Flow Index (MFI), the development reversal may be attributed to an influx of funds into ETH markets. The MFI is transferring towards the midline after sliding to 27 on Monday.

If consumers heed the decision to purchase Ether from the MACD, the liquidity backing this development reversal can be enhanced. A every day shut above two key ranges can be important for Ethereum value to validate the rally.

First, bulls should try to maintain ETH above the 50-day EMA and the 100-day. Secondly, short-term help at $1,800 is crucial for the continuing $2,000-bound value motion.

That stated, new lengthy positions in ETH might have to attend till Ethereum has validated the above situations. To a big extent, such validations would assist merchants keep away from bull traps which will result in sudden pullbacks.

Key help areas to be careful for within the occasion of a development correction beneath $1,800 embody the 200-day EMA (purple) at $1,728 and the potential help highlighted alongside the ascending trendline.

With Bitcoin halving set to happen in lower than ten months, analysts like Michaël van de Poppe are urging traders to contemplate shopping for altcoins like Ethereum. Halving is the occasion that slashes BTC miner rewards, thus decreasing provide to maintain inflation at a minimal.

Buy your #Altcoins.

Ten months previous to the halving is the perfect second.

This cycle is the large one.

Accumulate.

— Michaël van de Poppe (@CryptoMichNL) June 20, 2023

Halving occasions have additionally been related to the onset of the bull market. As provide and demand dynamics change, Bitcoin price begins to rally whereas pulling your complete crypto market up with it.

Buying Ethereum and different altcoins at the moment may give traders a golden probability to capitalize on the anticipated bull market in 2024 going into 2025.

Related Articles

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link