[ad_1]

Bitcoin value continues to indicate exemplary stability above $30,000. The pioneer cryptocurrency hit a 12-month excessive late final week at $31,468 however stalled to permit for consolidation.

Many market watchers anticipated BTC to retrace and retest help at $28,000, however the enhanced market construction bolstered by a sudden rise in curiosity from institutional traders has ensured Bitcoin price upholds its position above $30,000.

The largest cryptocurrency is buying and selling at $30,230 on Thursday, with $10.5 billion in buying and selling quantity recorded in 24 hours. Despite the steadiness exhibited, BTC is down 0.7%.

MicroStrategy Buys 12,333 BTC

The crypto market has been extraordinarily eventful this June, beginning with an intensified crackdown by the US Securities and Exchange Commission (SEC).

Leading crypto exchanges Coinbase and Binance have been sued by the regulator, with 64 cryptocurrencies, together with Cardano (ADA), Polygon (MATIC), and Solana (SOL), implicated as safety tokens.

However, the face of the crypto business began to alter with Blackrock’s debut out there, desiring to function a spot Bitcoin ETF. And since then, more institutional investors have both been expressing curiosity within the area as stakeholders or holders of the biggest crypto BTC.

Although MicroStrategy is a veteran investor in Bitcoin, its most recent purchase of 12,333 BTC price round $347 million is an indication that its time for Wall Street to enter the market.

MicroStrategy has acquired a further 12,333 BTC for ~$347.0 million at a mean value of $28,136 per #bitcoin. As of 6/27/23 @MicroStrategy hodls 152,333 $BTC acquired for ~$4.52 billion at a mean value of $29,668 per bitcoin. $MSTR https://t.co/joHo1gEnR0

— Michael Saylor⚡️ (@saylor) June 28, 2023

Institutional traders shunned the crypto marketplace for the final one and a half years amid regulatory uncertainty and different inside forces just like the implosion of Terra (LUNA) in May and FTX in November 2022.

MicroStrategy’s newest buy brings the whole quantity of BTC on its steadiness sheet to 152,333 – price round $4.5 billion.

Will Bitcoin Price Rally On Institutional Investors Surge?

Aside from MicroStrategy and Blackrock, firms like Fidelity Investments and Ledger have began operating crypto-based platforms.

Fidelity backs EDX Markets, a crypto change designed for brokers and particular person traders. Ledger, then again, has simply introduced the launch of Ledger Enterprise TRADELINK, a crypto service devoted to catering to the wants of institutional traders.

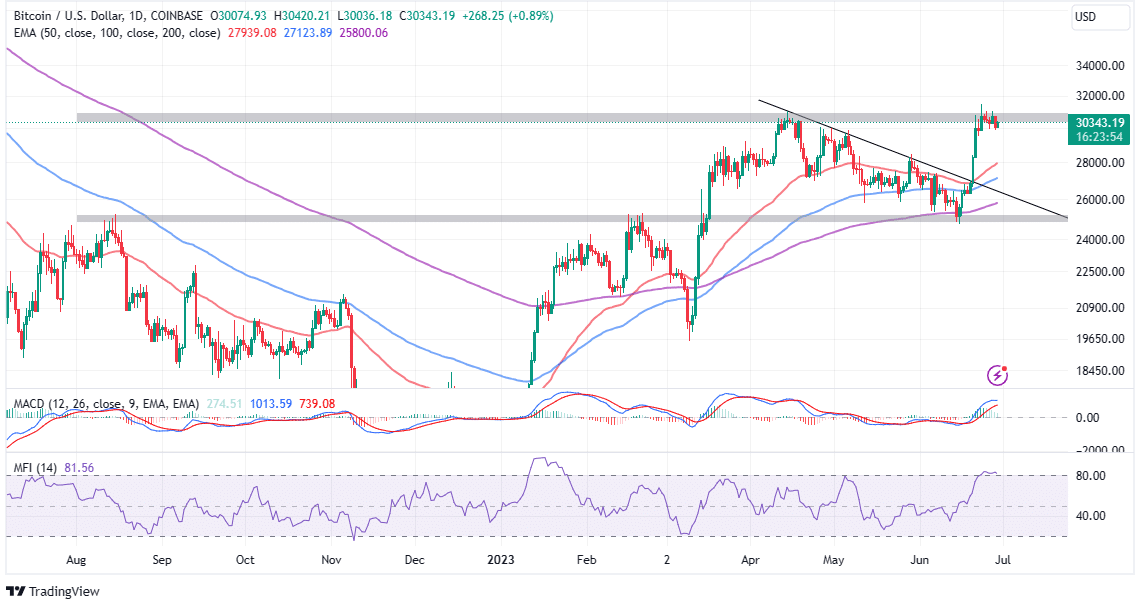

Meanwhile, Bitcoin price holds firmly above $30,000. This help is essential for the resumption of the uptrend concentrating on $38,000. The Money Flow Index (MFI) reinforces the steadiness out there, holding inside the overbought area.

This implies that the cash streaming into BTC markets is considerably greater than the outflow quantity. If these circumstances keep the identical or enhance, bulls could have a neater time pushing for a breakout to $38,000.

Traders should tread cautiously, conscious of the promoting strain emanating from the latest rejection from the 12-month excessive degree. If overhead strain continues to construct, they’ll anticipate a promote sign from the Moving Average Convergence Divergence (MACD) indicator.

In that case, it’s important to attend till Bitcoin value confirms a rebound from $30,000 and presumably breaks and holds above $30,000 to make sure of a brand new uptrend. However, it’s untimely to rule out one other rollback to $28,000.

Related Articles

The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link