[ad_1]

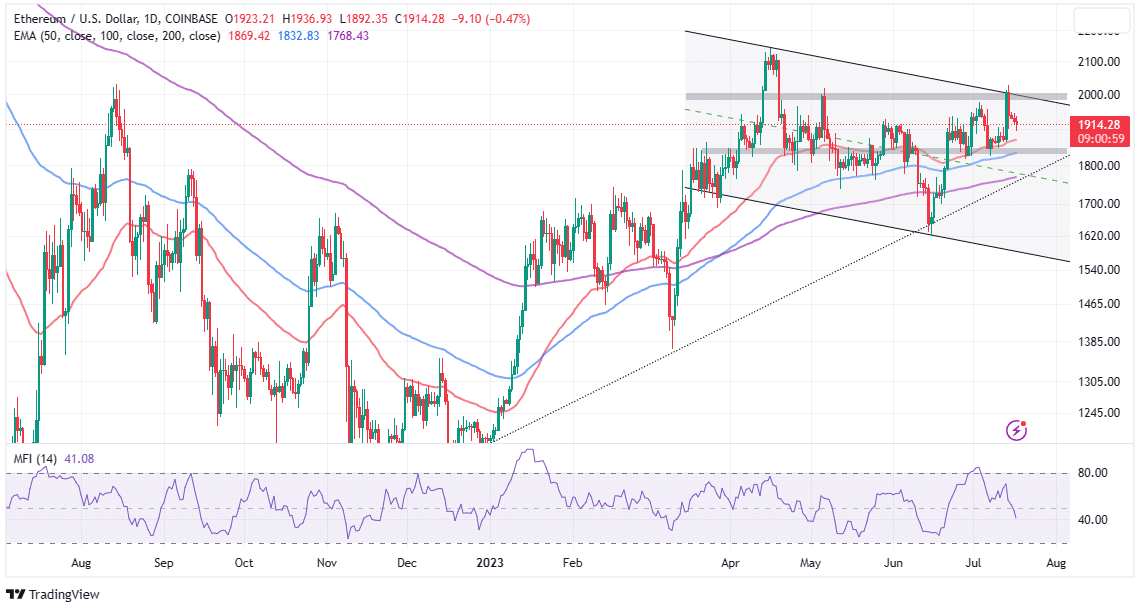

Ethereum value wobbles 0.8% whereas exchanging palms at $1,915 on Monday. The second-largest crypto battled an aggressive take-profit drive over the weekend, with ETH sliding from nearly a three-month excessive achieved final week at $2,015.

Traders can’t ignore the overhanging hazard of a pullback beneath Ethereum price’s fast help at $1,900, particularly with Bitcoin price delicately holding onto a high cliff’s edge, bolstered by the client congestion at $30,000.

A Minor Pullback But Open Interest is Climbing

Based on dwell knowledge from Coinglass, a platform for monitoring the crypto derivatives market, the Ethereum open curiosity is up by 0.98% to $6.26. Traders noticed $10.48 million of 24-hour liquidations, with $8.19 million in longs and $2.28 million in shorts.

Notably, rising open curiosity signifies that new cash is coming into the Ethereum market and that there’s extra curiosity and exercise within the spinoff contracts. It additionally implies that there’s extra liquidity and variety out there, as extra merchants are keen to take totally different positions and opinions.

Therefore, if Ethereum upholds the short-term support at $1,900 and the open curiosity maintains a constructive outlook, bullish momentum would construct up, thus creating an acceptable atmosphere for a breakout.

However, warning is commonly suggested if the value of the underlying asset, ETH on this case, is falling and the open curiosity can be rising. This suggests that there’s a robust bearish pattern and that extra merchants are opening quick positions or closing lengthy positions.

It is a detrimental signal for Ethereum and should point out additional value depreciation.

Can Ethereum Take on $2,000 Resistance to Rally?

Ethereum price is fighting for support at $1,900, following a rejection it confronted when it encountered the higher boundary of a descending channel. Further declines beneath $1,900 are extremely doubtless contemplating the open curiosity is climbing whereas the value struggles.

If help at $1,900 weakens paving the way in which for heightened promoting stress, bulls would prolong their gaze to the help supplied by the 50-day Exponential Moving Average (EMA) (in purple) at $1,869.

Traders searching for publicity to quick positions would goal the next help space as highlighted by the 100-day EMA (in blue) at $1,832, however this purchaser congestion extends to $1,800.

The Money Flow Index (IMF) provides credence to the bullish outlook as the cash influx and outflow indicator shut in on the oversold area.

Most merchants could select to attend patiently till Ethereum value confirms a pattern reversal from the above-mentioned help ranges.

A day by day shut above $1,900 coupled with the next northbound motion eyeing $2,000 could set off FOMO, calling buyers to enter the market and guess on a bigger uptick to $2,200, which could ultimately transition to $3,000 because the momentum builds the rally.

Two of probably the most important breakout determinants are resistance at $2,000 and help at $1,900. Losing this help may very well be detrimental to Ethereum’s uptrend however breaking the $2,000 hurdle may very well be the much-awaited rally ticket to $3,000.

Related Articles

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

[ad_2]

Source link