[ad_1]

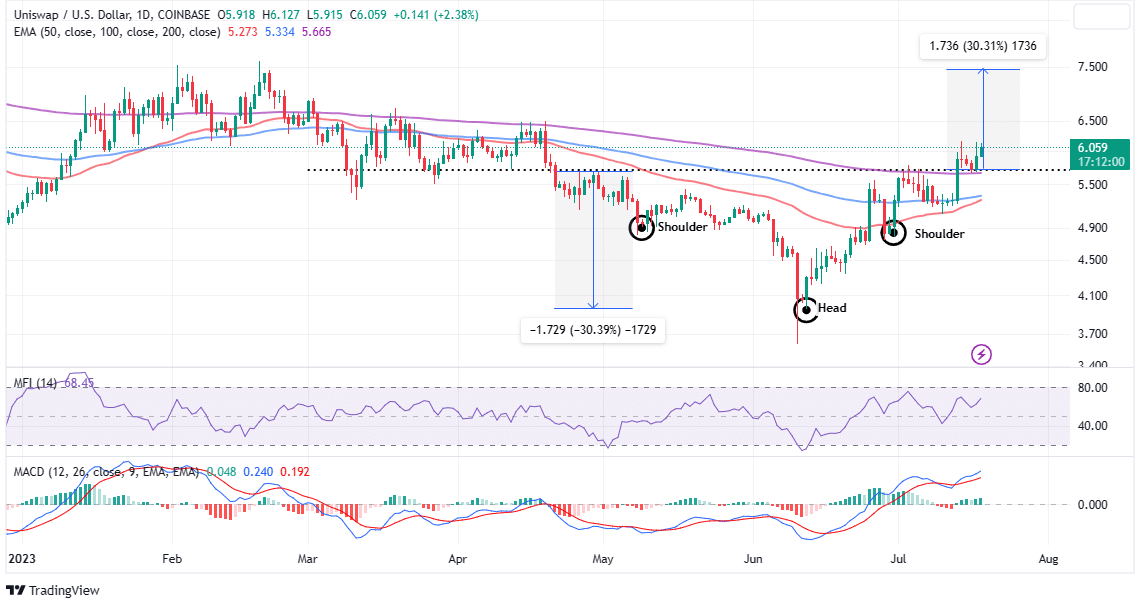

Uniswap, a decentralized exchange (DEX) ecosystem, might turn out to be one of the best-performing crypto belongings this week, following an inverse head-and-shoulders (H&S) sample breakout.

Up 15% during the last week, UNI is buying and selling barely above $6 with $219 million in buying and selling quantity dashing in. Uniswap is the world’s nineteenth largest cryptocurrency boasting $4.6 billion in market capitalization.

Will the Inverse Head-And-Shoulders Pattern Propel Uniswap to $7.5?

Uniswap has since mid-June sustained a formidable uptrend from month-to-month lows of $3.6 to July highs of $6.148. The development reversal accomplished the formation of an inverse head-and-shoulders when bulls confirmed assist at $4.8, calling for extra publicity to UNI longs forward of an anticipated breakout above the sample’s neckline resistance at $5.73.

An inverse H&S sample is a bullish sign that exhibits the Uniswap market is about to change from a downtrend to an uptrend. The sample seems on the chart like an individual’s head and shoulders flipped the other way up.

The head represents the bottom level and the shoulders are greater. The neckline is the resistance degree that connects the tops of the shoulders.

Since Uniswap worth has already validated the H&S sample by breaking above the neckline, it confirms the sample, and merchants count on a rally.

Traders are anticipated to purchase UNI on the breakout level, $5.73 on this case, and goal for a goal worth that is the same as the gap from the pinnacle to the neckline added to the breakout level, which as noticed on the chart could propel Uniswap worth 30% to $7.50.

For starters, Uniswap would be in the best position to rally to $7.50 if bulls uphold assist above $6. Extremely conservative merchants could need to wait till UNI has confirmed the validity of this purchaser congestion zone earlier than triggering their purchase orders.

In case of a reverse, it will be prudent to attend till Uniswap price bounces off the neckline resistance at $5.73, strengthened by the 200-day Exponential Moving Average (EMA) (in purple) at $5.665.

For now, the trail with the least resistance is crucial to the upside, with extra merchants keen to wager on one other purchase sign from the Moving Average Convergence Divergence (MACD) indicator. Usually, a bullish cross is characterised by the MACD line in blue flipping above the sign line.

The Money Flow Index (MFI) equally provides credence to the bullish outlook indicating that the influx of funds into UNI markets considerably surpasses the outflow quantity. In different phrases, enhanced investor curiosity within the token powering one of crypto’s largest DEX backs the anticipated 30% H&S breakout.

Uniswap Labs Debuts New Beta Protocol

The Uniswap improvement staff introduced the launch of a brand new beta protocol referred to as UniswapX. According to an accompanying Twitter publish, that is “a new permissionless, open-source (GPL) auction-based protocol for trading across AMMs and other liquidity sources.”

2/ UniswapX is next-level aggregation 💪

It outsources the complexity of routing to an open community of fillers who compete to fill swaps at the very best costs.

Read the small print in our whitepaper:https://t.co/ZfzvLB9bil pic.twitter.com/oljZtRMz1j

— Uniswap Labs 🦄 (@Uniswap) July 17, 2023

Uniswap believes this new offering will “give users more liquidity, better prices, MEV protection, and gas-free swapping.” On high of all these options, UniswapX customers will incur any price for failed transactions, to not point out the gas-free cross-chain swap anticipated to launch quickly.

Related Articles

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link