[ad_1]

STMX token recorded uncommon value actions in the previous couple of hours, resulting in hypothesis of market manipulation amongst market watchers.

The sudden rise of the token, adopted by a speedy descent, has left a number of derivatives merchants liquidated. Binance additionally up to date its STMX futures contract.

STMX Crashes After Surge

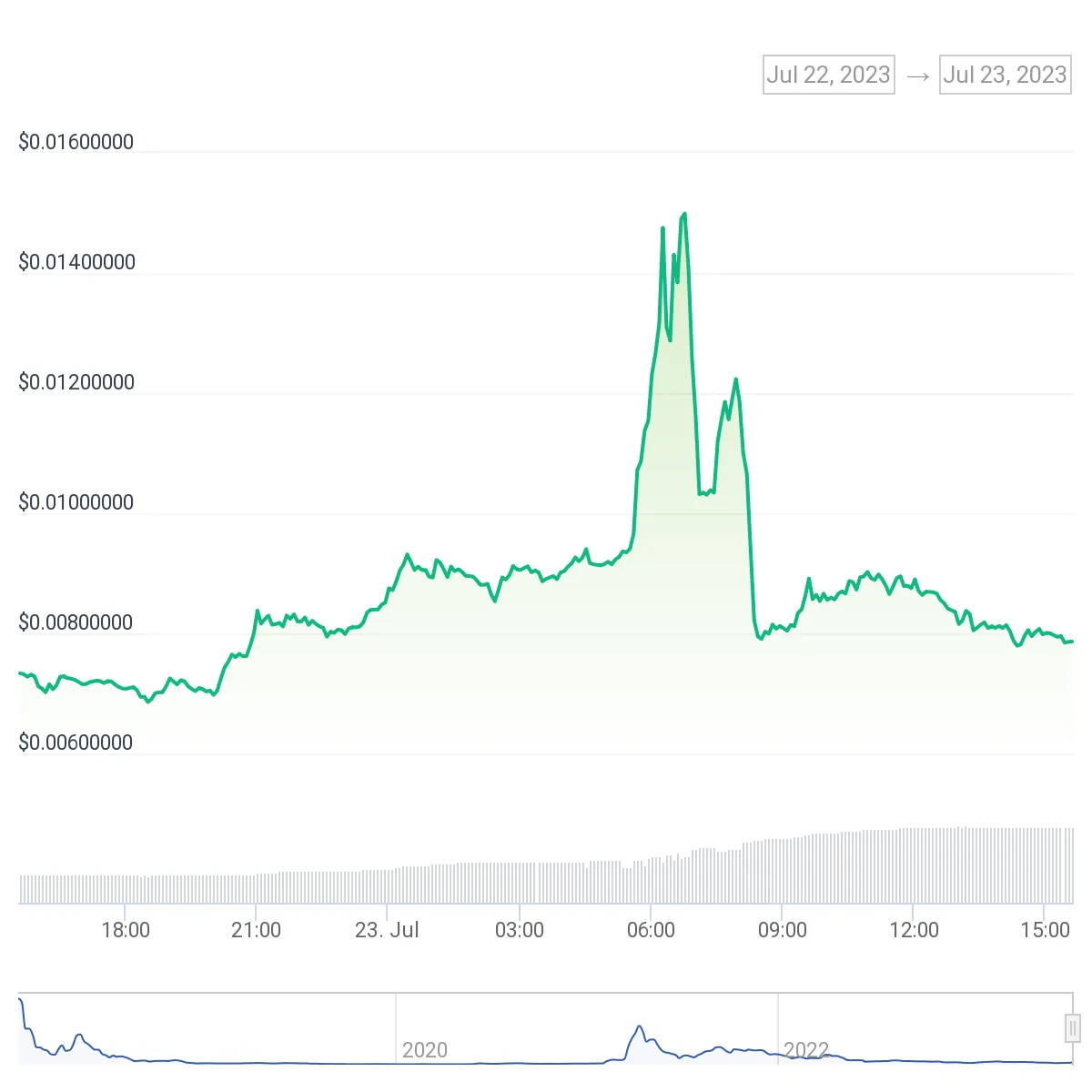

The token, which trades on a number of exchanges, together with Binance, recorded a large surge in its value during the last 24 hours. It peaked at $0.015 earlier at the moment however quickly noticed a speedy decline in value, dropping by about 45% to $0.0081.

Data from Coingecko reveals it has risen barely to $0.0089 and gained 104% within the final seven days.

The unusual price movements in the previous couple of hours have raised issues about market manipulation, though no clear proof helps these claims. Wu Blockchain reported that the South Korean trade UpBit accounts for 72% of the buying and selling quantity of $495 million.

STMX is the native token of StormX, a platform that permits customers to earn crypto cashback by buying on a number of on-line marketplaces listed on its app.

Liquidations for STMX Futures Traders

The price movements have additionally resulted in large liquidations for individuals who held STMX positions. Data from Coinglass reveals that STMX liquidations within the final 24 hours are $3.78 million. The liquidations affected bears and bulls, with $2.77 million in brief and $1.01 million in lengthy liquidations.

Binance customer support said that its staff investigated the incident and would supply extra data later.

“Regarding the emergency incident of the $stmx contract, the relevant team is dealing with it urgently. Further information will be synchronized with you later.”

The assertion additionally directed these affected to make use of the net customer support to fill out the enchantment kind.

An announcement on the Binance web page earlier at the moment additionally mentioned that Binance Futures would replace the leverage and margin tiers of the USDⓈ-M STMXUSDT Perpetual Contract on 2023-07-23 at 07:15 (UTC).

It would additionally enhance the funding fee settlement frequency for the contract from each eight hours to each 2 hours and lift the capped funding fee multiplier from 0.75 to 1.

Users had been suggested to regulate their place and leverage earlier than the changes as it could have an effect on present open positions and will result in liquidations.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. However, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material.

[ad_2]

Source link