[ad_1]

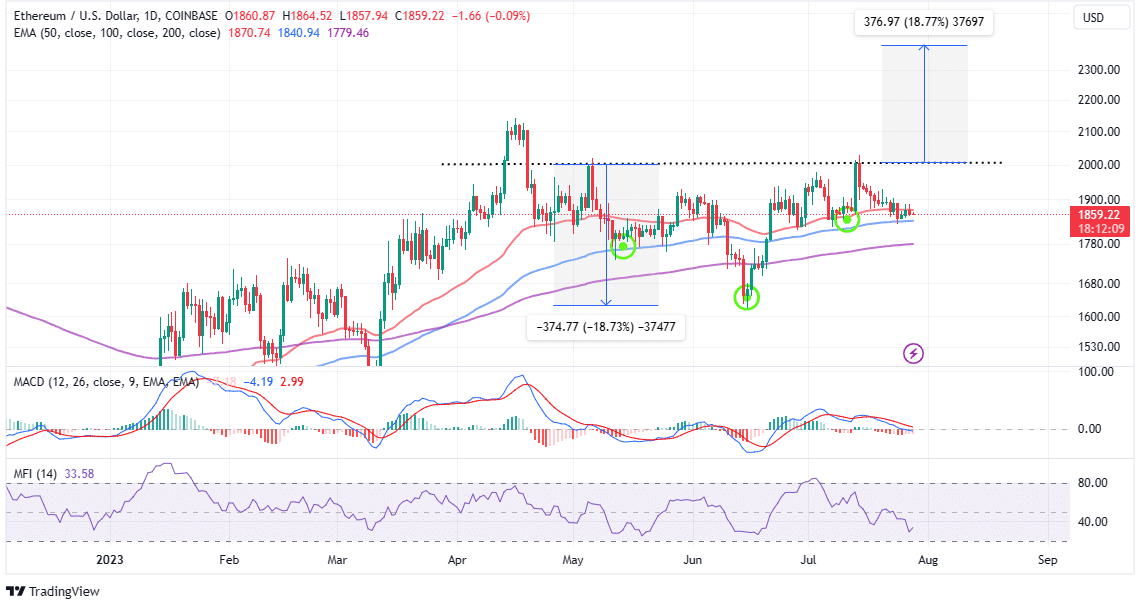

Ethereum value has steadied above $1,800 for practically two months and traded at $1,864 on Friday. On the upside, value motion has been capped beneath $2,000, amid a normal hunch within the buying and selling quantity.

Following the Ripple ruling in early July, traders centered much less on Bitcoin (BTC) and Ethereum, favoring different main altcoins like XRP, Cardano (ADA), Polygon (MATIC), Solana (SOL), and most lately Dogecoin (DOGE).

The greatest process amongst Ethereum is holding the value above $1,800 – a transfer more likely to forestall doable declines to $1,700 and $1,600.

If a restoration ensues from the present market worth, the token powering the most important good contracts token may set off a surge in investor curiosity, who’re nonetheless ready on the sideline for an uptrend affirmation above $2,000.

Here’s What It Will Take Ethereum to Rally?

Ethereum price is in the course of nurturing a doubtlessly huge breakout that would propel it not solely above $2,000 however enable bulls to shut the hole to $2,400 for the primary time since May 2022.

The day by day chart reveals the formation of an inverse head-and-shoulders (H&S) sample, promising a 19% bullish transfer to $2,385.

The inverse H&S sample reveals a downtrend ending and an uptrend beginning. It has three lows: the center one is the bottom (head) and the outer ones are increased (shoulders).

This sample is validated when the value breaks above a line becoming a member of the highs of the shoulders (neckline), situated round $2,000 for Ethereum value.

Traders are at all times suggested to purchase when this occurs or watch for a pullback to the neckline to make sure that the breakout is sustainable and never a bull entice. Note that the value goal is the gap from the pinnacle to the neckline (19%) added to the breakout level.

Other indicators have to be consulted when buying and selling the H&S, particularly the Money Flow Index (MFI), which screens the influx and outflow of funds in Ethereum markets. That mentioned, the MFI as offered on the day by day chart, has a bullish outlook, which means {that a} breakout is within the offing.

Evaluating the Bullish Case in Ethereum Price

Adding credence to the bullish outlook on the day by day chart is the Moving Average Convergence Divergence (MACD) indicator – more likely to ship a purchase sign over the weekend.

Traders looking for contemporary publicity to ETH lengthy positions must be looking out for bullish crosses within the momentum indicator, marked by the MACD line in blue crossing under the sign line in purple.

To be on the protected aspect, Ethereum price must break and hold above the immediate hurdle, as highlighted by the 50-day Moving Average (EMA) at $1,870. Profit reserving can begin at $2,000 however extraordinarily bullish merchants could wish to maintain on for the H&S sample breakout to $2,385.

Related Articles

The offered content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link