[ad_1]

Bitcoin is on the verge of triggering one other downfall after wobbling throughout the mid-week climb to $26,800. The largest crypto market cap, turned inexperienced this week, though briefly following extraordinarily oversold circumstances within the earlier week. As anticipated, BTC value positively impacted major altcoins like Ethereum, which climbed to $1,700 earlier than rolling again to $1,650 on Friday.

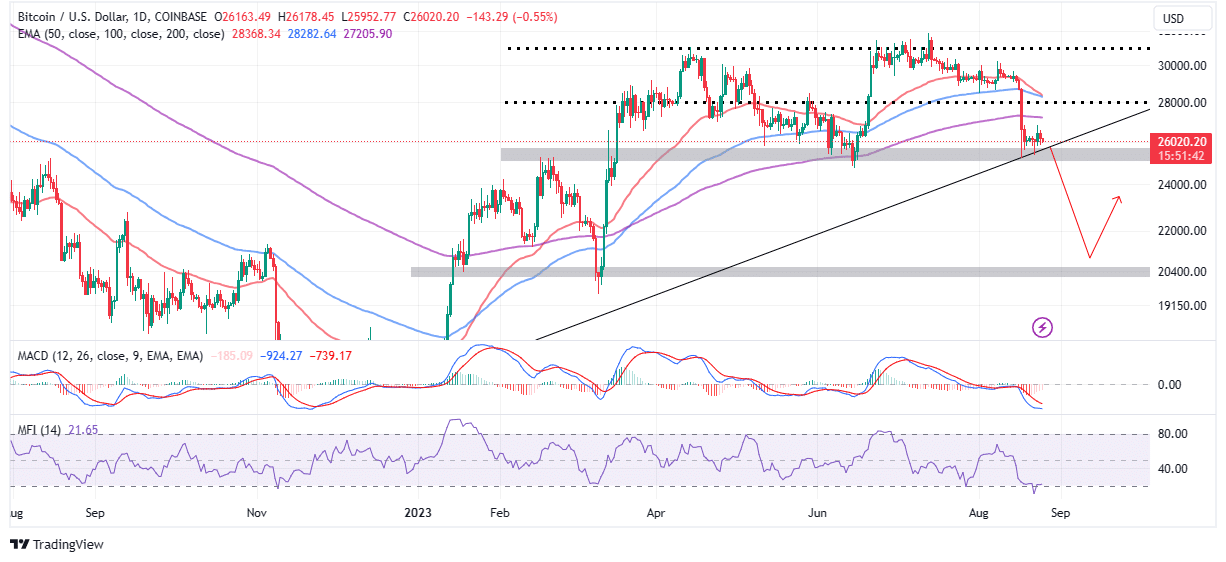

BTC Price At A Crossroads – Going To $30k or $20k?

Although hovering at $26,000 on the time of writing, BTC value is in a precarious place the place quick merchants consider it’s poised for an additional dip to $23,500 for the conservative ones and $20,000 for these stubbornly bearish.

The technical outlook on the every day chart affirms the bearish stance, beginning with the Moving Average Convergence Divergence (MACD) indicator’s promote sign. As lengthy as this momentum indicator holds the downtrend in place beneath the imply line (0.00) the trail with the least resistance will stay downward.

An reverse final result can be thought-about because the blue MACD line flips above the pink sign line. Such a transfer would encourage extra patrons to hunt publicity to BTC following the drop to $25,000, in flip, contributing to the momentum for positive aspects concentrating on $30,000.

The Money Flow Index (MFI) reveals that sellers have the higher hand. This indicator measures the sum of money flowing into and out of Bitcoin markets. Since the outflow quantity considerably overwhelms the influx quantity, declines are prone to stick with it.

Despite this worrisome technical scenario, a rebound will be anticipated at $25,000 – a assist strengthened by a multi-month ascending trendline, relationship again to January. Crypto analyst @CryptoFaibik shares the identical sentiment primarily based on his submit on X that “$25k needs to hold to save the bulls.”

$BTC #Bitcoin 25k must Hold to save lots of the Bulls. pic.twitter.com/DOFhmsLqNn

— Captain Faibik (@CryptoFaibik) August 25, 2023

BTC Price Rebound Awaits This Condition

The Bitcoin Dominance has in accordance with @CryptoFaibik fallen to a stage that’s hindering the resumption of the uptrend. Currently at 49.25%, the BTC dominance is down nearly 5.5% from 52.1% firstly of July.

A drop in Bitcoin dominance implies that buyers are specializing in the altcoins extra and fewer on BTC. A spike within the metric would imply that the biggest crypto has the momentum and liquidity to climb increased.

$BTC might Bounce Back if its Dominance Rebounds.#Crypto #Bitcoin #BTC pic.twitter.com/Q9nlJa2XfI

— Captain Faibik (@CryptoFaibik) August 25, 2023

Bitcoin Supply On Exchanges Dips to Pre-2017 Levels

Bitcoin’s supply on exchanges has continued to fall regardless of the crypto winter. Investors choose to carry their cryptos away from exchanges when they don’t intend to promote within the quick time period. Low provide on exchanges is seen as a constructive issue characterised by decreased potential promoting stress and a attainable breakout.

👋 Just 5.8% of #Bitcoin is at present sitting on exchanges, which is formally the bottom stage #crypto‘s prime market cap asset has seen since December 17, 2017. We are additionally persevering with to see cheap quantities of $BTC whale transactions (57.4K per week). https://t.co/c0vfjFEvvG pic.twitter.com/nNnz2JDJyb

— Santiment (@santimentfeed) August 24, 2023

Another issue buyers can faucet to comfortably preserve their positions in BTC intact is the dialogue amongst merchants “referring to the current market conditions as a bear market.”

According to Santiment, “when traders show FUD, the probability of price rises increases considerably.” Therefore, irrespective of the place BTC breaks all the way down to, a bull market is imminent, particularly with the halving approaching in about eight months.

Related Articles

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

[ad_2]

Source link