[ad_1]

BTC worth has began to rebound following the early week sell-off which almost weakened assist at $25,000. Following the retail investor capitulation in August, whales have began promoting with some closing out their positions probably with the hope of reentering at cheaper price factors – say $22,000.

“Giant whales in the last two days of trading a large number of buy monthly Put, in today’s rally has been loss, from the current position structure and trading data, the whales divergence is obvious, some believe that the 25,000 defense line is solid, but there is also a part of the people began to bets on the decline, which caused the short-term put IV rise is obvious,” Greeks.stay stated by way of Twitter.

BTC and ETH are lastly rebounding as we speak after yesterday’s crash, however the costs are nonetheless at lows since June.

The whales have been promoting the 25,000P and 1,600P within the final month, however there’s a disagreement between the whales final week. Some of them have began to shut out… pic.twitter.com/yf3hDMMk3X— Greeks.stay (@GreeksReside) September 12, 2023

BTC Price Bulls On The Move Again

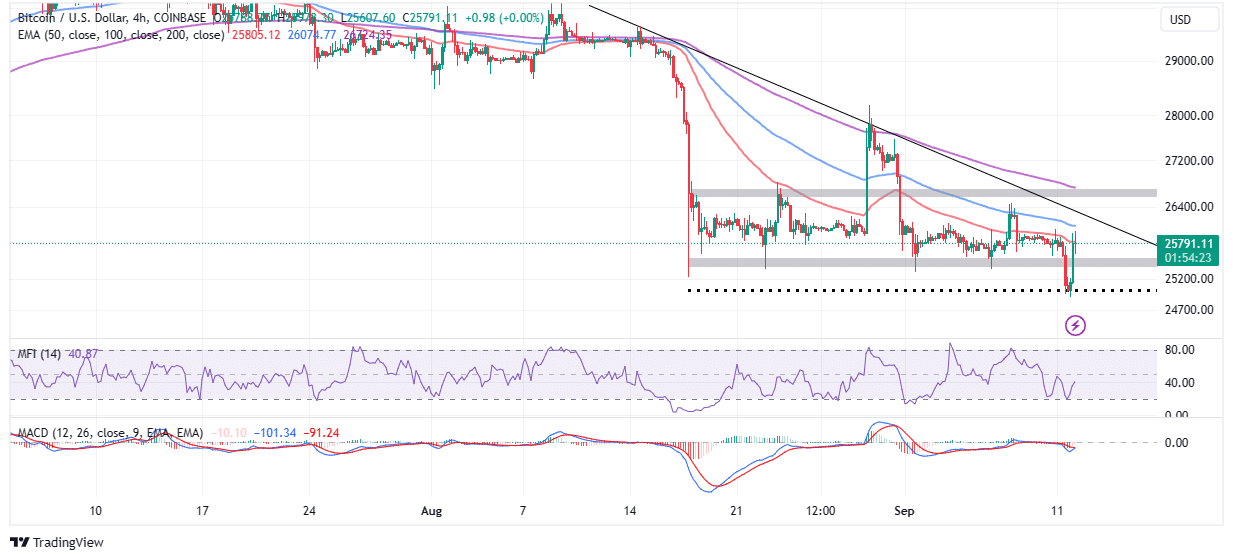

Bitcoin’s live price, though comparatively unchanged over the past 24 hours, is buying and selling at $25,655. Defending the $25,000 assist was an element that buyers wanted to verify earlier than rallying behind BTC worth for a possible breakout to $30,000.

An incoming purchase sign from the Moving Average Convergence Divergence (MACD) indicator can be instrumental in solidifying the uptrend. That stated, merchants hoping for publicity to lengthy positions in BTC should think about ready till the MACD line in blue crosses above the sign line in crimson.

Based on the Money Flow Index (MFI), there are extra folks within the bullish outlook for BTC price than these favoring a continued downtrend, particularly after the $25,000 assist was defended.

The MFI measures the influx quantity of funds into Bitcoin and compares that to the outflow quantity. The ongoing restoration from near-oversold ranges means that patrons have the higher hand.

However, a pointy transfer to the bullish goal at $30,000 would possibly stay a pipe dream within the brief time period, particularly if the earlier assist at $26,000 is just not reclaimed.

The vendor congestion on the 50-day Exponential Moving Average (EMA) implies that bulls have to be prepared for a fierce problem with the sellers, particularly would whales who goal new entries at $22,000 and $20,000 relying on the provision of liquidity.

Several key milestones would assist to verify the knowledge of positive factors lowering the hole to $30,000 beginning with a each day shut above the 50-day EMA and subsequently the resistance/assist at $25,000. The final push to $30,000 would rely upon the bulls’ capability to weaken the vendor congestion on the descending trendline.

Related Articles

The introduced content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: