[ad_1]

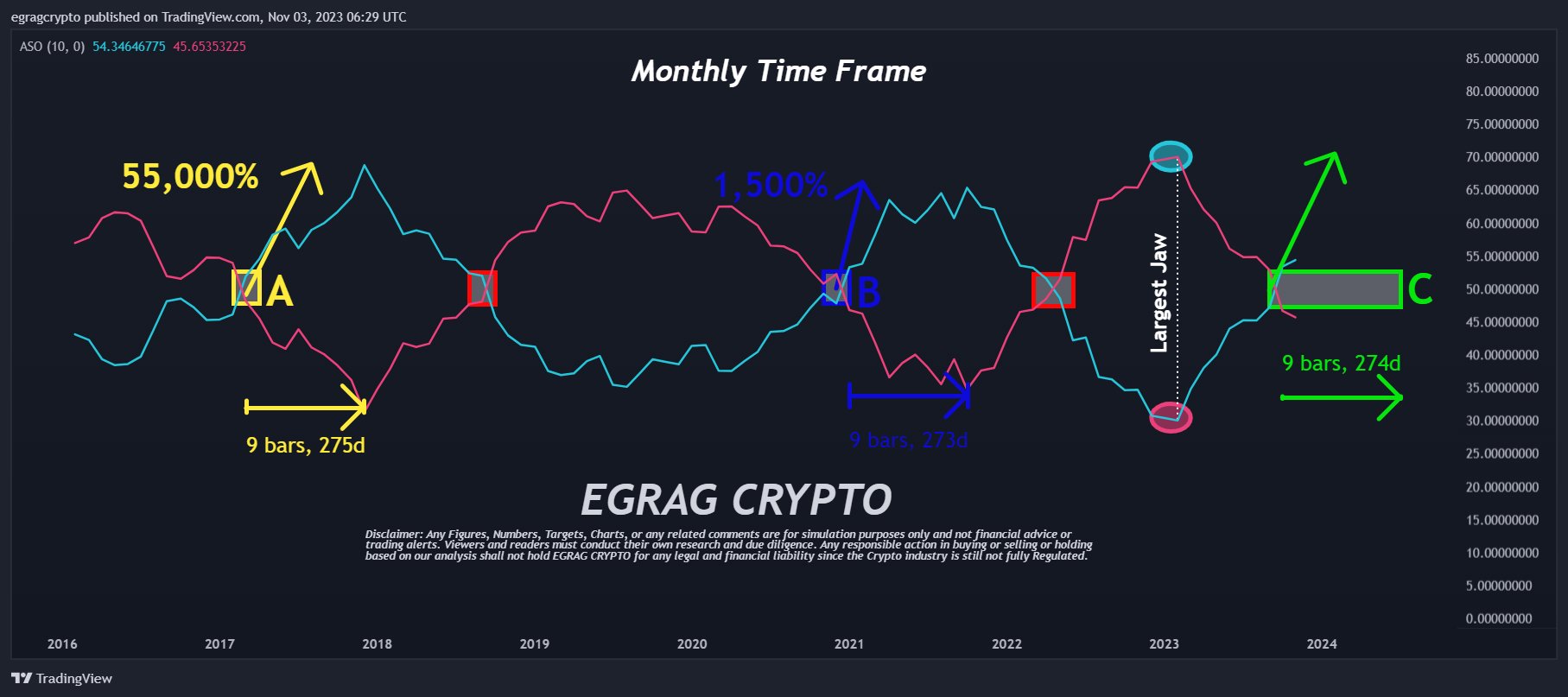

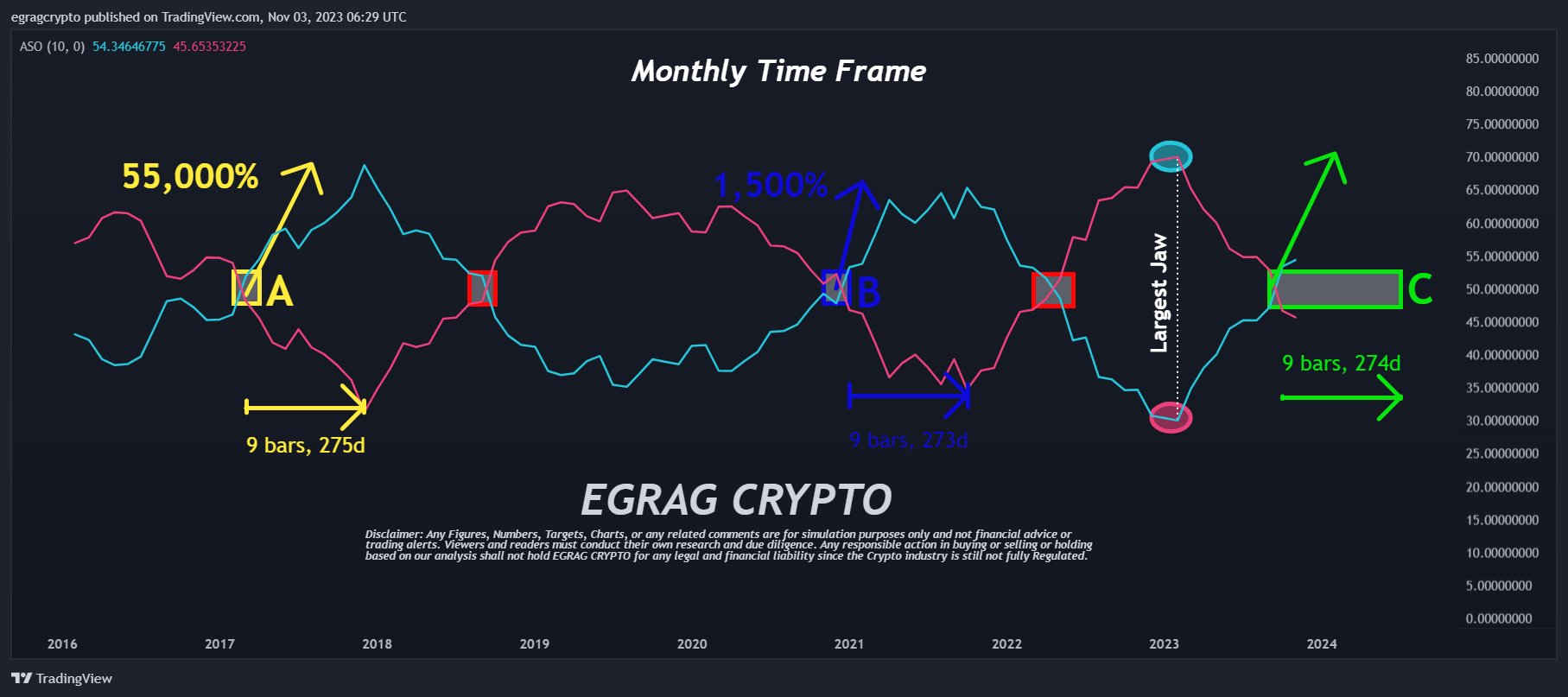

Crypto analyst Egrag not too long ago delved into the XRP value charts and spotlighted indicators that counsel a attainable rally of greater than 1,500% is on the horizon. The focus of this analysis is the ASO (Average Sentiment Oscillator), a metric that merchants make use of to find out market sentiment.

XRP Price Rally Of 1,500%+ Ahead?

Egrag’s month-to-month XRP/USD chart showcases the convergence of the blue line, symbolizing bulls, and the purple line, representing bears. A month in the past, Egrag had marked a yellow field on his chart, predicting the bullish crossover to happen between the top of 2023 or the onset of the latter half of 2024.

Today, Egrag famous, “XRP ASO Update: The journey is only heading UP! I’ve been eagerly awaiting the bullish crossover of the ASO since February 2023. And guess what? It’s finally here!” Should XRP mimic its historic patterns, and if Egrag’s predictions maintain true, the XRP value may witness some appreciable value actions within the coming months.

Historically, the cryptocurrency skilled this bullish crossover twice earlier than. The 2017 occasion led to a staggering 55,000% enhance in XRP’s value, whereas the one from late 2020 to April 2021 resulted in a 1,500% appreciation. Given the “largest jaw” ever noticed on the chart, Egrag has sparked discussions suggesting that the forthcoming rally may even outpace its predecessors.

By connecting the dots from the historic knowledge and the current crossover, Egrag additional elaborated, “Looking at historical data, we can see that it typically takes around 275 days to reach the peak after this event.” If XRP follows its historic traits, as Egrag suggests, the XRP value is likely to be gearing up for some substantial value motion throughout the subsequent 7-10 months.

Ending his tweet on a rallying notice for the huge group of supporters, generally known as the ‘XRP Army’, Egrag inspired, STAY STEADY and carry on sporting your house swimsuit.”

To present extra context, the ASO acts as a momentum oscillator, giving averaged percentages of bull/bear sentiment. It’s notably potent in discerning sentiment throughout particular candle intervals, aiding in pattern identification or pinpointing entry/exit moments. The device was conceived by Benjamin Joshua Nash and modified from its MT4 model. The oscillator’s design, showcasing Bulls % with a blue line and Bears % with a purple line, illuminates the prevailing sentiment available in the market.

At press time, XRP traded at $0.5990. Upon analyzing the 1-day chart, it’s evident that the XRP value confronted a second rejection on the 0.382 Fibonacci retracement stage, which stands at $0.625.

Although the RSI has settled considerably, it stays elevated within the overbought zone at 71. This means that the value may gear up for one more shot at overcoming this resistance. However, if it doesn’t succeed, a pullback to the 0.236 Fibonacci retracement stage, priced at $0.553, could also be on the horizon. On the upside, the 0.5 Fibonacci retracement stage, pegged at $0.683, represents the subsequent potential value goal.

Featured picture from Shutterstock, chart from TradingView.com

[ad_2]

Source link