[ad_1]

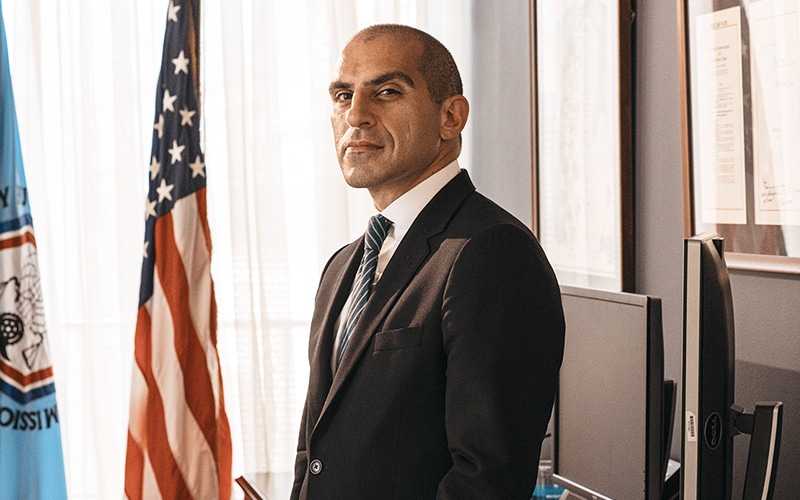

Despite the tumultuous downfall of FTX and the conviction of its former CEO Sam Bankman-Fried, the potential for related crises in the cryptocurrency market stays excessive, based on Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam. Speaking at a current convention at Georgetown University, Behnam emphasised that the panorama of crypto markets, though completely different from a yr in the past, nonetheless harbors the likelihood of one other FTX-like occasion.

Behnam’s remarks come nearly a yr after he urged the Senate Banking Committee to determine cryptocurrency regulatory frameworks swiftly. His name for motion, aimed toward safeguarding buyers and mitigating systemic dangers, echoes in a regulatory vacuum. The crypto market has advanced because the pandemic’s onset, but the basic vulnerabilities that facilitated the FTX collapse nonetheless should be addressed.

Congress Grapples with Complex Crypto Regulations

The legislative course of to control cryptocurrencies has been gradual and sophisticated. Two vital payments managed to advance out of the House Financial Services Committee in the course of the summer time, focusing on the regulation of stablecoins and establishing a complete framework for crypto regulation. However, their journey is much from over. These payments should move a full vote in the House earlier than shifting on to the Senate, the place garnering assist could possibly be difficult.

Moreover, different lawmakers are pushing for stringent laws to fight the use of cryptocurrencies in cash laundering and sanction evasion. Behnam noticed that these legislative efforts appear to be in a “holding pattern,” indicating an absence of consensus or urgency amongst lawmakers. As identified by Behnam, this stagnation in Congress leaves the digital commodity market in a precarious state, missing complete regulation.

CFTC Chair Seeks Clarity in Crypto

Behnam’s message underscores the necessity for a transparent regulatory roadmap. He reiterated his stance from the earlier yr’s Senate Banking listening to, emphasizing the CFTC’s restricted authority in comprehensively regulating the digital commodity market. Without applicable legislative empowerment, the CFTC and different regulatory our bodies are constrained in preemptively addressing the dangers inherent in the crypto market.

The persistence of these dangers, coupled with the gradual legislative course of, paints a regarding image for the long run of cryptocurrency regulation in the U.S. Behnam’s name to motion isn’t just a mirrored image on previous occasions just like the FTX collapse however a forward-looking concern in regards to the stability and security of the crypto market. The stability between fostering innovation in the burgeoning area of digital currencies and making certain investor safety and market integrity stays a vital but unresolved problem for lawmakers and regulators alike.

Read Also: Germany’s Commerzbank Bags Crypto Custody License

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: