[ad_1]

Bitcoin continues to make robust strikes with the BTC value capturing one other 1.5% transferring all the best way to $38,000 ranges earlier right now. As per a number of on-chain metrics, bulls appear to be gaining an higher hand whereas organising their eyes on $40,000 and past.

USDT Buying Price is Growing

Over the final six months, the 100 largest Tether wallets have collected greater than $1.67 billion in USDT tokens. This reveals that the shopping for energy has elevated by a staggering 10% throughout this time.

On-chain information supplier Sanitment reported that the Bitcoin value has reached $38,300 for the primary time since May 5, 2022. This surge is attributed to varied components, with a major contributor being the highest 100 largest Tether (USDT) addresses, which have collectively added $1.67 billion up to now six months.

The growing shopping for energy of those whale USDT addresses suggests a bullish development, and if this momentum continues, analysts anticipate the probability of Bitcoin surpassing $40,000 within the close to future.

Popular crypto platform Greeks.Live reviews that following the month-to-month supply, Bitcoin has surged, breaking the $38,000 mark and establishing a brand new excessive for the 12 months. This upward motion has additionally contributed to the restoration of Dvol, which had beforehand dropped to 51% after the supply however has now returned to its current common of 54%.

Market sentiment is at the moment extremely optimistic concerning the potential approval of the Exchange-Traded Fund (ETF) within the first quarter of the subsequent 12 months. Skew’s vital constructive bias, constant for over a month, aligns with market expectations. Investors are suggested to take into account each decline as a good alternative to improve their positions till the ETF is formally adopted.

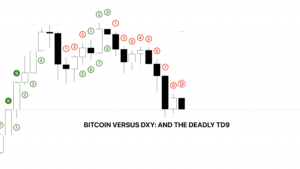

Bitcoin Price Action Ahead

Bitcoin’s upward momentum is going through resistance across the $38,000 mark, however the subsequent declines have been transient and minor, indicating persistent demand from consumers looking for alternatives throughout value consolidation.

This sample varieties an ascending triangle on the worth chart, characterised by a horizontal higher resistance round $37.8K and a rising decrease assist from shallow pullbacks. The shallower nature of current declines suggests a rising bullish sentiment, and analysts like Alex Kuptsikevich from FxPro anticipate a possible breakout above $40,000, contemplating the ascending triangle formation. However, the query stays on how quickly can this occur?

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: