[ad_1]

BTC worth surpassed the $38,000 stage for the primary time since May 2022 as Bitcoin bulls held strongly this month. The Bitcoin futures buying and selling on CME continued to rise and surpassed the world’s largest crypto trade Binance, indicating large demand from institutional traders. CME Bitcoin futures has now turned bullish for a rally previous $40,000.

CME Bitcoin Futures Suggest Rally To $40,000

Bitcoin bulls proceed to push BTC worth upside because the market sentiment improves after the supply of the month-to-month choices. Retail and institutional traders are actually extra assured about BTC worth hitting $40,000 and shutting the 12 months close to $45,000.

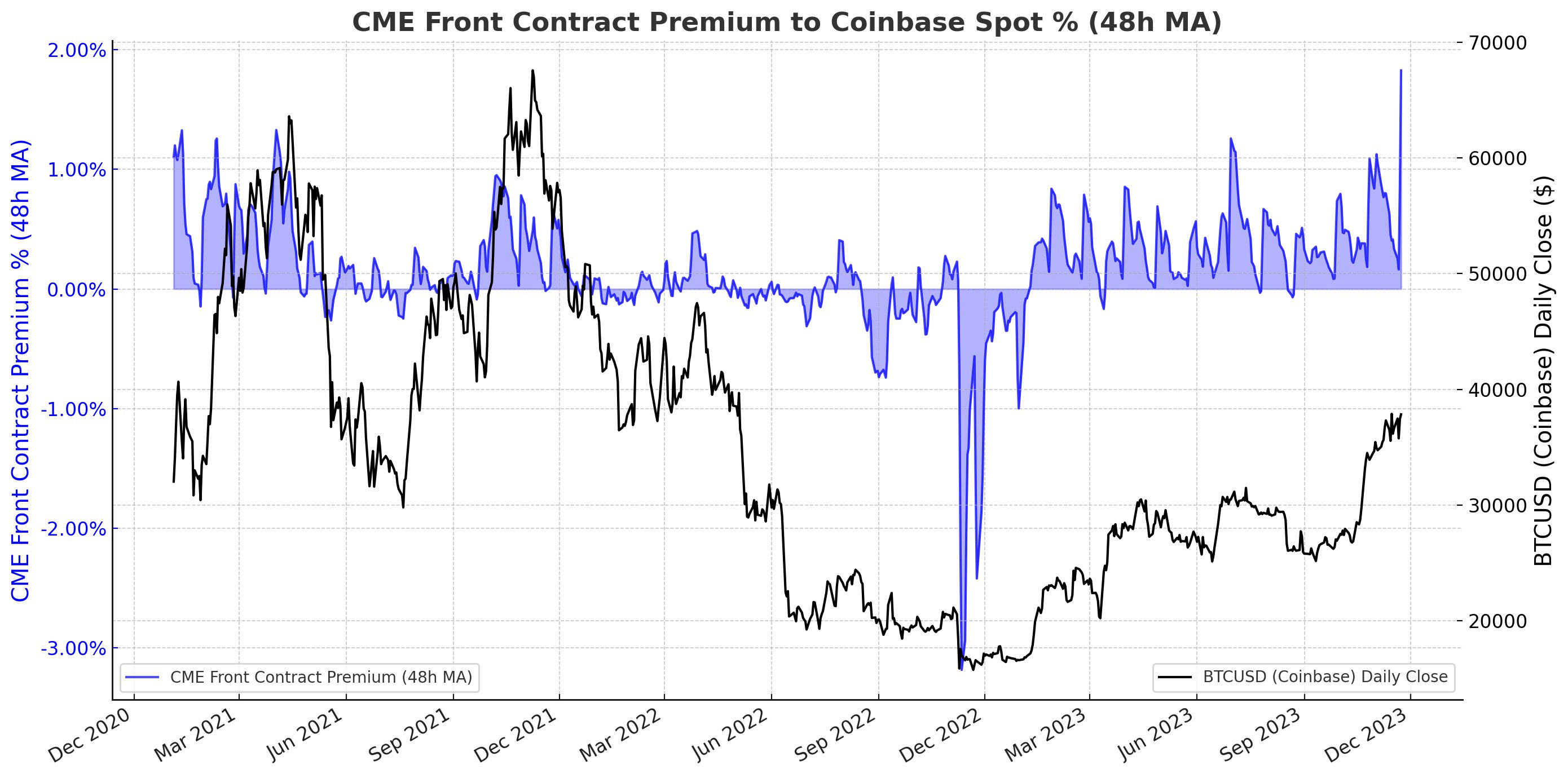

CME Front Contract Premium % to Coinbase spot at an all-time excessive amid optimistic sentiment. CME Bitcoin futures traded at a excessive of $39,300 at one level within the final 24 hours, virtually a $1,000 premium to the spot worth. It occurs as futures and choices merchants stay bullish on Bitcoin.

Improved market and bullish sentiment from institutional traders ETFs like ProfessionalShares’ BITO, which invests in CME-listed bitcoin futures, contributes to the premium.

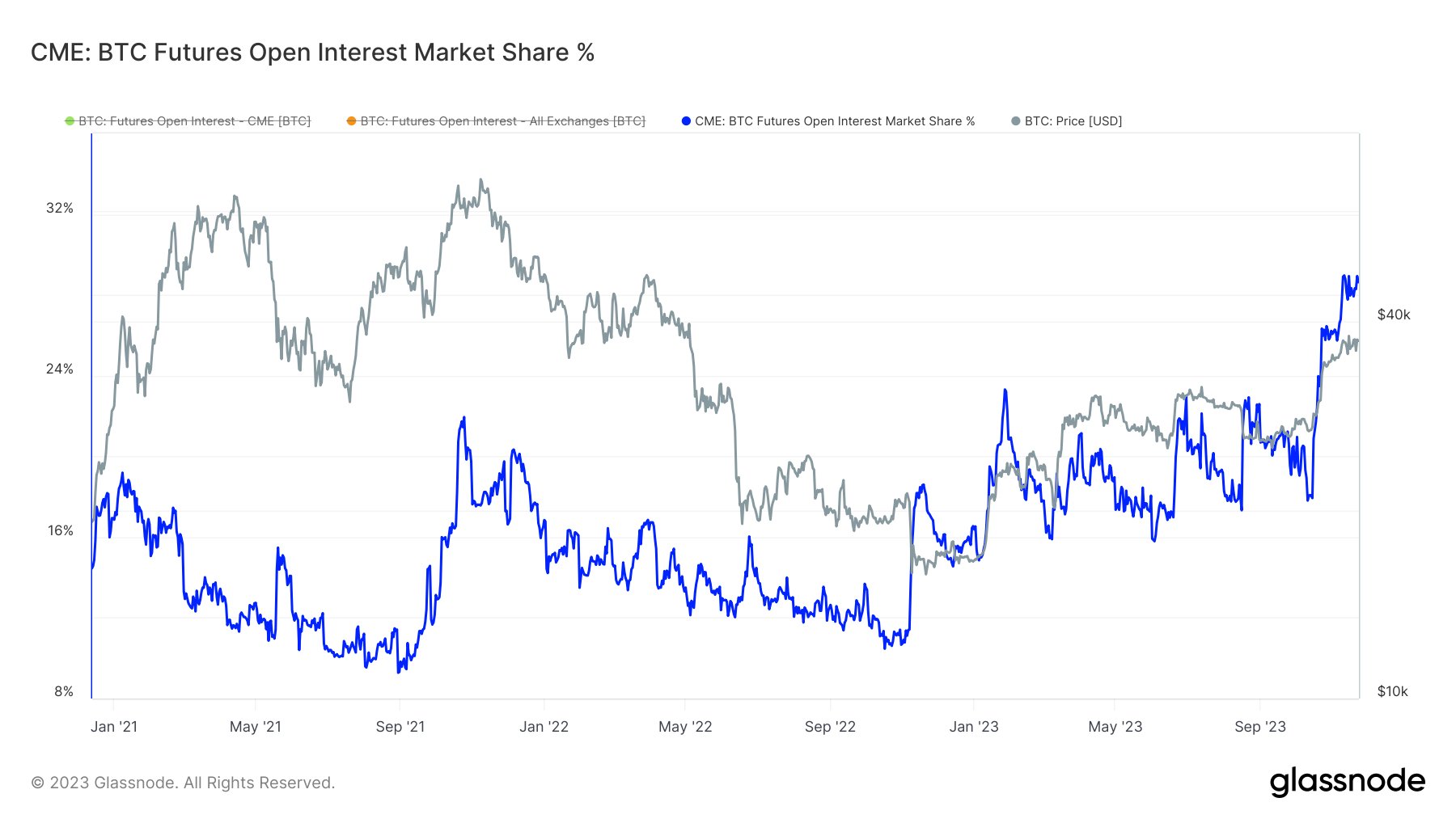

Meanwhile, CME Bitcoin Futures Open Interest Market Share Percent has additionally hit greater, reaching virtually 30%. It follows as Bitcoin and former CEO CZ agreed to federal criminal charges and pay $4.3 billion in settlement with U.S. authorities.

Moreover, it signifies institutional traders stay bullish and proceed to make bets on Bitcoin. Crypto funds inflow has considerably elevated in the previous few weeks, with Bitcoin driving the crypto market to rally greater.

Also Read: Crypto Market Continues Rally With BTC, Pepe Coin, SEI Rising

BTC Price Gains Strength

BTC price jumped 2% up to now 24 hours, with the worth at the moment buying and selling at $37,818. The 24-hour high and low are $37,369 and $38,415, respectively. Furthermore, the buying and selling quantity has elevated by 70% within the final 24 hours, indicating an increase within the curiosity of merchants.

This surge is attributed to varied components, with a major contributor being the top 100 largest Tether (USDT) addresses, which have collectively added $1.67 billion up to now six months. This confirms an upcoming rally backed by optimistic sentiment and better buying and selling volumes.

Matrixport analysis predicted that Bitcoin worth would hit $45k in 2023 and $125K by December 2024 after a large post-halving rally.

Also Read: BLUR & Blast Founder Responds to Rumors of Ponzi Scheme, Addresses Security Concerns

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: