[ad_1]

Arthur Hayes, the founding father of BitMEX, has provided an in-depth evaluation of the present monetary panorama and its potential influence on Bitcoin, particularly in gentle of the latest challenges confronted by New York Community Bancorp (NYCB) and the broader banking sector.

Hayes’s evaluation attracts on the advanced interaction between macroeconomic insurance policies, banking sector well being, and the cryptocurrency market. His feedback are significantly insightful given the recent developments with NYCB. The financial institution’s inventory plummeted by 46% as a result of an surprising loss and a considerable dividend lower, which was primarily attributed to a tenfold enhance in mortgage loss reserves, far exceeding estimates.

This incident raised pink flags in regards to the stability and publicity of US regional banks, significantly in the actual property sector, which is understood to be cyclically delicate and weak to financial downturns. The inventory market reacted negatively to those developments, with regional US financial institution shares additionally declining as a result of NYCB’s efficiency.

Weekend Rally Ahead For Bitcoin?

Hayes explicitly stated, “Jaypow [Jerome Powell] and Bad Burl Yellen [Janet Yellen] will be printing money very soon. NYCB annc a ‘surprise’ loss driven by loan loss reserves rising 10x vs. estimates. Guess the banks ain’t fixed.” This remark underscores the persisting fragility of the banking sector, nonetheless reeling from the shocks of the 2023 banking disaster. He added, “10-yr and 2-yr yields plunged, signaling the market expects some sort of renewed bankster bailout to fix the rot.”

Furthermore, Hayes highlighted the upcoming conclusion of the Federal Reserve’s Bank Term Funding Program (BTFP), which was launched in response to the 2023 banking disaster. The BTFP was a crucial instrument in offering liquidity to banks, permitting them to make use of a wider vary of collateral for borrowing.

Hayes anticipates market turbulence resulting in the Fed presumably reinstating the BTFP or introducing comparable measures. In a latest assertion, he noted, “If my forecast is correct, the market will bankrupt a few banks within that period, forcing the Fed into cutting rates and announcing the resumption of the BTFP.” This state of affairs, he argues, would create a liquidity injection that might buoy cryptocurrencies like Bitcoin.

In his newest submit on X, Hayes drew parallels to the cryptocurrency’s efficiency in the course of the March 2023 banking disaster. He predicts the same trajectory, suggesting a quick dip adopted by a major rally:

Expect BTC to swoon a bit, but when NYCB and some others dump into the weekend, anticipate a brand new bailout proper fast. Then BTC off to the races similar to March ’23 worth motion. […] I feel it is likely to be time to get again on the practice fam. Maybe after just a few US banks chew the mud this weekend.

During the March crisis, Bitcoin’s worth jumped over 40%, a response attributed to its perceived position as a digital gold or a safe-haven asset amid monetary instability. On an extended time horizon and with the Great Financial Crisis from 2008 in thoughts, he additional argued, “What did the Fed and Treasury do last time US property prices plunged and bankrupted banks globally? Money Printer Go Brrrr. BTC = $1 million. Yachtzee.”

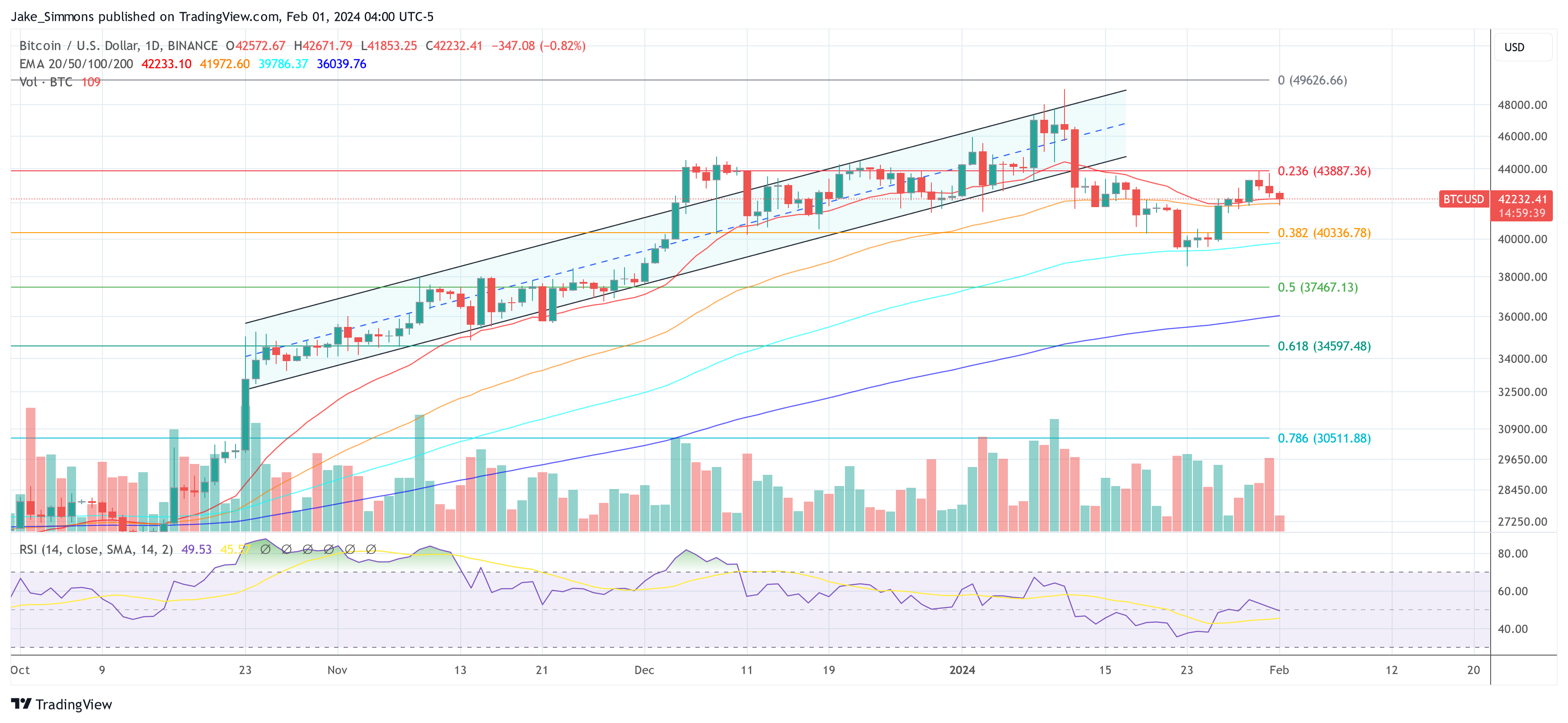

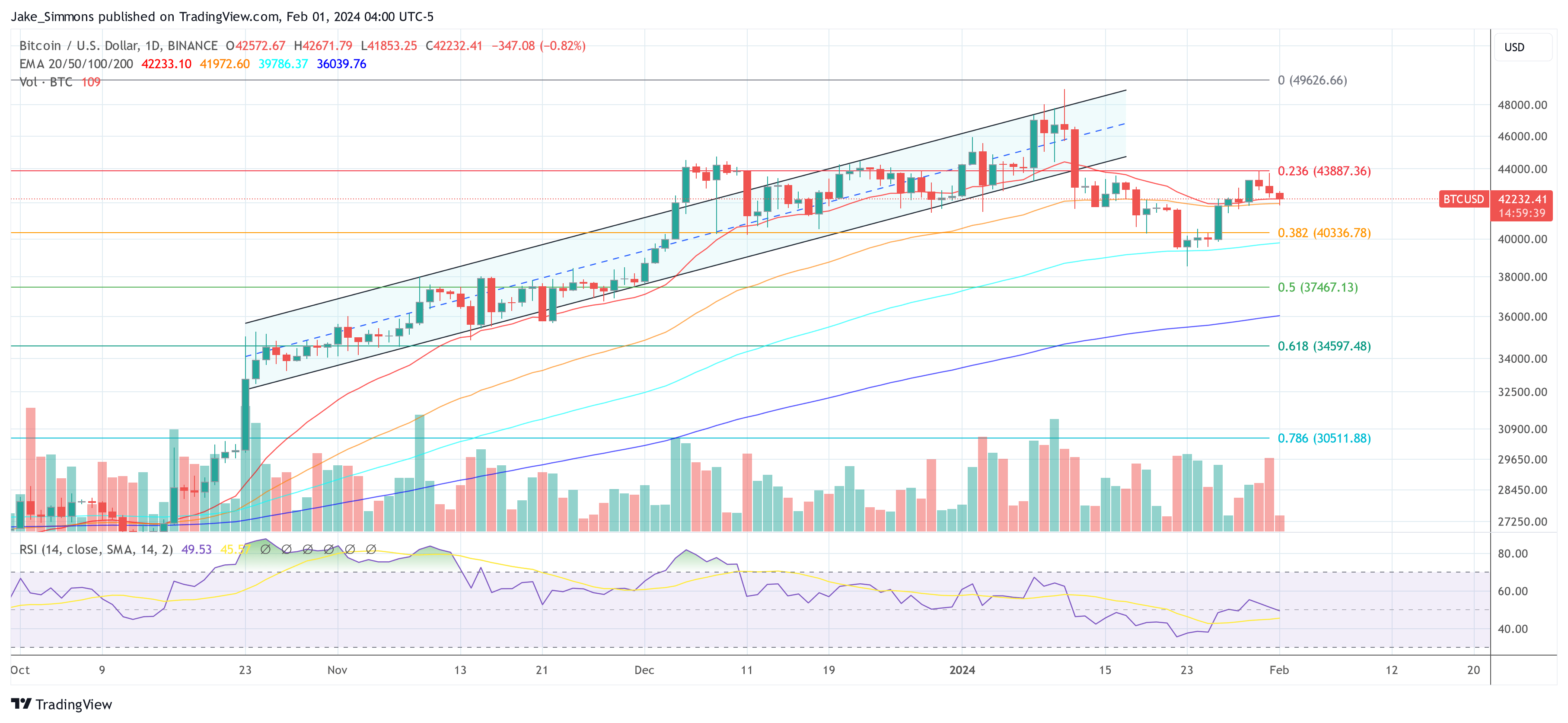

At press time, BTC traded at $42,232.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site completely at your individual threat.

[ad_2]

Source link