[ad_1]

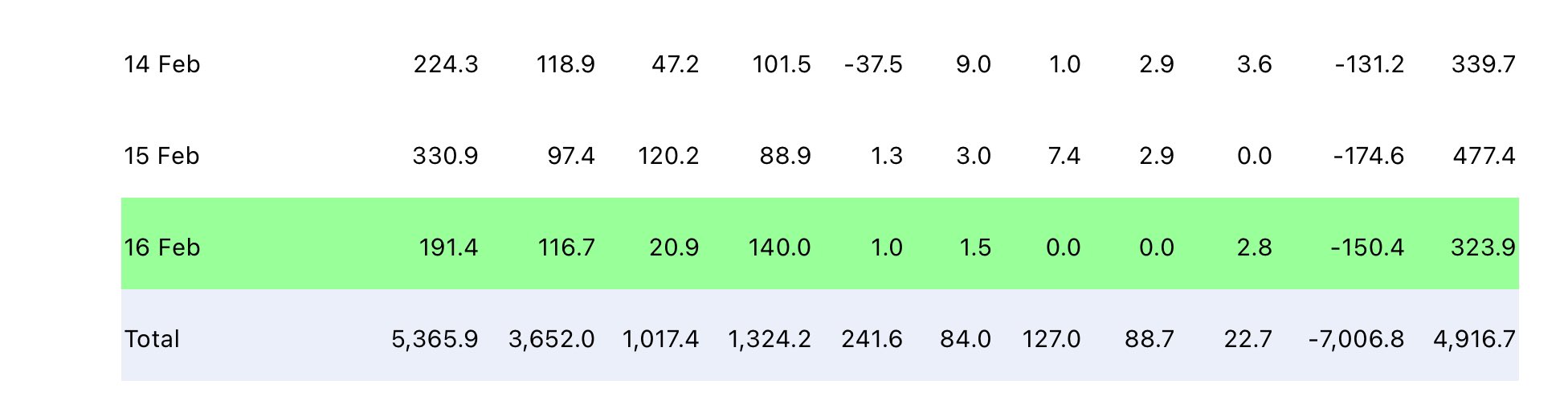

Spot Bitcoin ETFs ended the week with $323.90 million inflows on Friday, barely decrease than the $477 million Bitcoin ETF influx on Thursday. The Bitcoin ETFs sometimes have excessive internet influx on final buying and selling days of the week, however a attainable provide crunch over excessive demand and fewer Bitcoin sellers induced a slowdown.

Bitcoin ETF Net Inflows

According to the most recent information by BitMEX Research, spot Bitcoin ETFs noticed $323.90 million internet influx on Friday. Following the most recent influx, Bitcoin ETFs have now recorded a internet influx of almost 5 billion. It means over 100,000 BTCs have moved into spot Bitcoin ETFs since launch.

BlackRock’s iShares Bitcoin ETF (IBIT) noticed one other huge influx of $191.4 million on Friday, with the overall influx up to now surpassing $5.36 billion. IBIT leads by a large margin, with BTC holdings of greater than 119.6K valued at over $6.2 billion.

On Friday, Ark 21Shares Bitcoin ETF (ARKB) recorded second highest influx of $140 million. Followed by $116.7 million in Fidelity Bitcoin ETF (FBTC) and $20.9 million in Bitwise Bitcoin ETF (BITB).

Grayscale Investments’ GBTC witnessed $150.4 million outflow, slowing from Thursday’s outflow of $174.6 million. Thus, the web influx for spot Bitcoin ETFs, excluding GBTC, was truly $474.3 million. Meanwhile, GBTC internet outflow has now surpassed 7 billion.

Also Read: Coinbase Custody Alone Manages 90% of All Bitcoin ETFs Assets

BTC Price Steady at $52K

BTC price transferring vary certain close to the $52K degree, with the value at the moment buying and selling at $51,944. The 24-hour high and low are $51,641 and $52,537, respectively. Price actions have been risky after the US PPI launch on Friday.

Furthermore, the buying and selling quantity has decreased additional by 28% within the final 24 hours, indicating a decline in curiosity amongst merchants as value strikes sideways. Analysts predicted sideways or down actions within the subsequent few days.

The vital influx into BTC ETFs is poised to affect the crypto market dynamics profoundly. On-chain information suppliers, together with CryptoQuant, counsel that the sustained shopping for strain from these ETFs might propel Bitcoin’s value to new heights.

Also Read: Bitcoin (BTC) Retail Participation Drops But Institutions Contribute to Supply Squeeze

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: