[ad_1]

Ethereum fanatics are celebrating right now because the cryptocurrency’s worth surges by 5%, edging nearer to the $4,000 milestone. This spectacular rally is fueled by substantial Ethereum accumulation and constructive market sentiment, signaling a possible upward trajectory for ETH.

Besides, the robust accumulation of the second-largest crypto has additionally sparked discussions over an extra rally in Ethereum worth within the coming days.

Massive Ethereum Accumulation Boosts Market Confidence

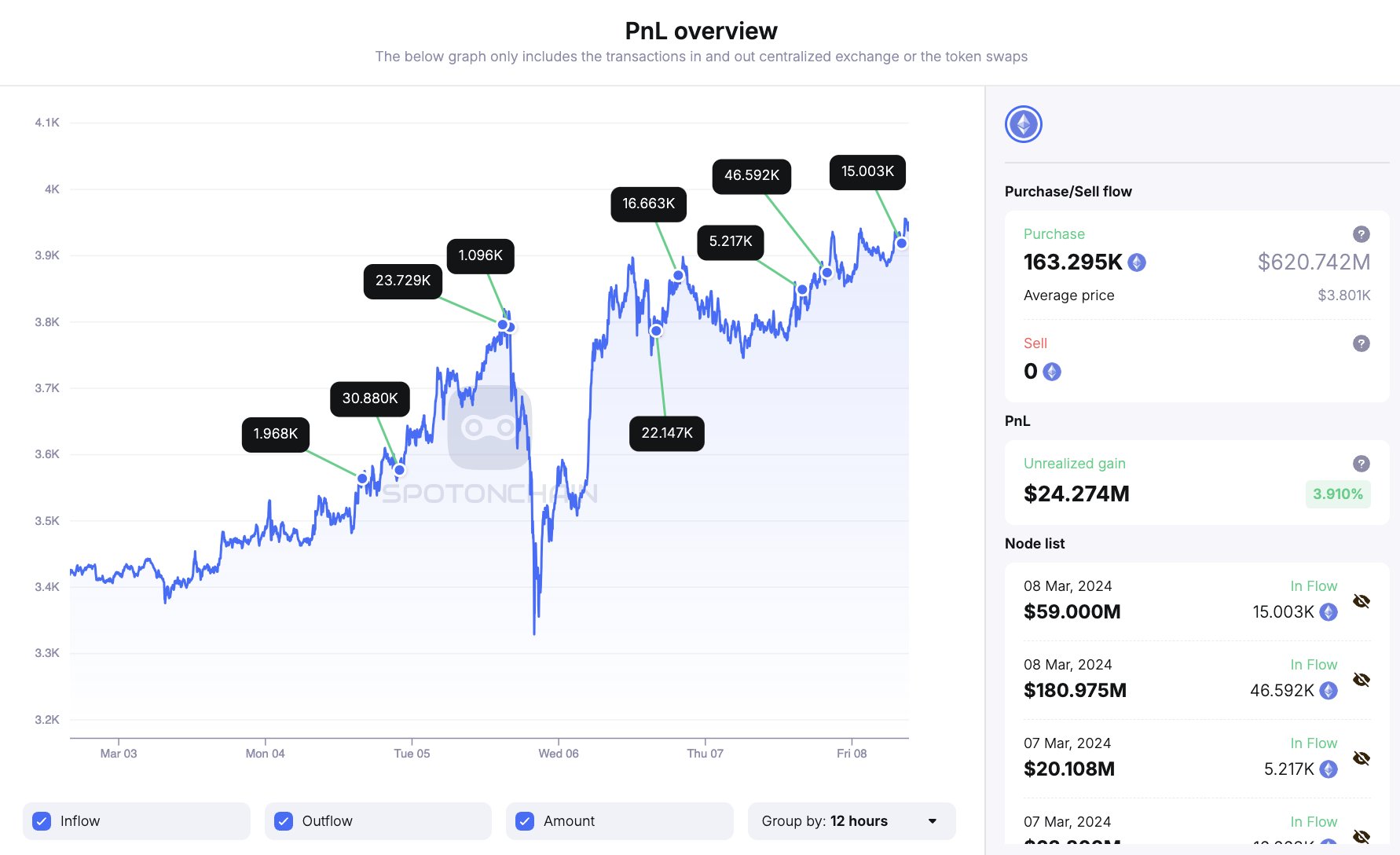

Recent information from the blockchain monitoring platform, Spot On Chain, reveals a surge in Ethereum accumulation, offering a powerful basis for the cryptocurrency’s worth rally. Over the previous few days, wallets related to Pulse Chain and Pulse X have bought a staggering quantity of ETH, totaling 163,295 ETH price roughly 620.7 million DAI.

Notably, the blockchain monitoring platform, Spot On Chain, reveals important on-chain ETH purchases linked to Pulse Chain/X wallets. In the newest replace, 15,003 ETH have been acquired utilizing 59 million DAI right now, totaling 163,295 ETH over 4 days. This marks a mean worth of $3,801 and an estimated unrealized revenue of $24.3M.

Meanwhile, in a earlier report, Spot On Chain famous a surge in ETH purchases, with 51,809 ETH purchased utilizing 201 million DAI, driving costs above $3,900. In simply three days, 21 Pulse Chain/X wallets purchased 148,288 ETH with 561.7M DAI at roughly $3,788, leading to a revenue of $21.8M. These transactions underscore the energetic engagement of Pulse Chain/X wallets within the cryptocurrency market, influencing ETH costs and producing substantial income.

Also Read: BONK Price Rallies 10% Amid BitMEX’s Listing and Airdrop Announcement

Market Sentiment Signals Positive Road Ahead

A flurry of different elements just like the upcoming Dencum upgrade, Ethereum ETF anticipation, and others, has additionally sparked market optimism over Ethereum’s future efficiency. Notably, the approaching Dencun improve is about to revolutionize ETH’s proof-of-stake protocol on March 13.

Meanwhile, the improve goals to handle congestion, improve scalability, and cut back transitions on layer networks. In addition, anticipation for an Ethereum ETF, pending SEC approval, boosts investor confidence. Drawing inspiration from the success of Bitcoin ETFs, market watchers predict a possible Ethereum worth rally.

In addition, Ethereum’s Open Interest surged by 3.71% to $13.25 billion, with Ethereum Options Open Interest additionally rising by 1.63% to $6.38 billion, as per CoinGlass data. With the improve promising important enhancements and ETF hopes on the horizon, Ethereum’s market outlook stays optimistic.

As of writing, the Ethereum price was up 4.53% during the last 24 hours and traded at $3,956.53, whereas its one-day buying and selling quantity fell 20.65% to $21.63 billion. Notably, during the last 24 hours, the ETH worth has seen a excessive of $3,958.81 and a low of $3,768.02.

Also Read: Conflux Network Announces First Hong Kong Dollar-Backed Stablecoin

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

[ad_2]

Source link

✓ Share: