[ad_1]

Ethereum (ETH) has been displaying a strong efficiency these days, leaving buyers each ecstatic and cautious. The world’s second-largest cryptocurrency, boasting a market capitalization of practically $480 billion, just lately surpassed the coveted $4,000 mark for the primary time since December 2021, igniting a flurry of bullish predictions. But is that this a real resurgence, or are we witnessing a brief blip earlier than a possible correction?

Let’s dissect the forces at play. Proponents of a sustained uptrend level to a confluence of constructive elements. The long-awaited approval of a US-based Ethereum ETF is a scorching subject, with hypothesis swirling {that a} inexperienced gentle might set off a major inflow of institutional capital, doubtlessly injecting billions into the Ethereum ecosystem.

Additionally, the upcoming Bitcoin halving, an occasion that cuts Bitcoin’s mining reward in half, is predicted to have a constructive spillover impact on the whole cryptocurrency market, doubtlessly propelling Ethereum additional.

Surge In Short-Term Ethereum Holders Signals Optimism

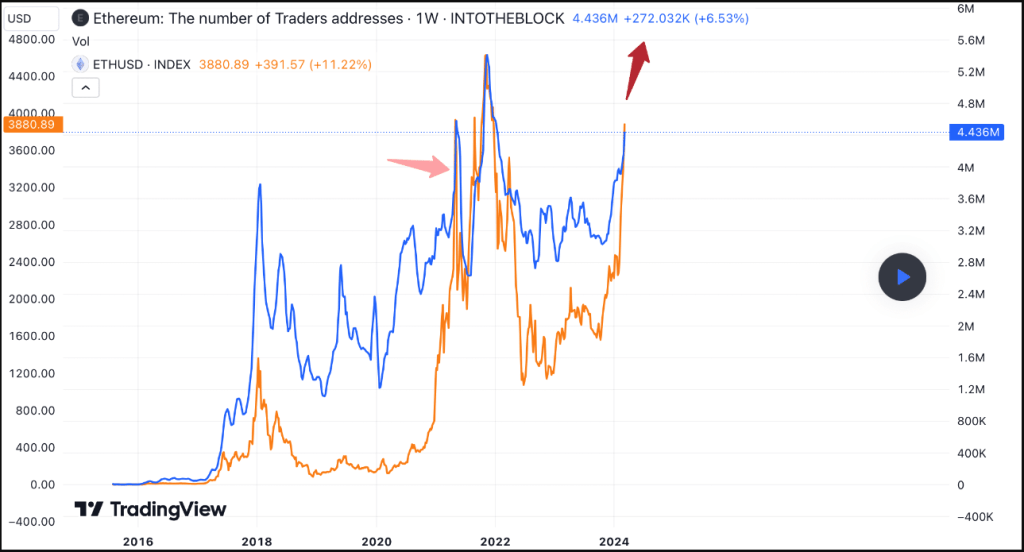

This optimistic outlook is bolstered by a surge in on-chain exercise. Data from IntoTheBlock reveals a major improve within the variety of short-term Ethereum holders.

Source: TradingView/IntoTheBlock

Historically, this development, with its 60% month-to-month worth surge for ETH, aligns with bull markets, signifying an inflow of latest customers getting into the crypto area and actively collaborating within the community. Think of it as a crowded social gathering – the extra folks present up (presently approaching the highs of the final bull cycle), the livelier the ambiance turns into (and doubtlessly the upper the value goes).

But, there’s extra to the story. A nearer inspection of technical indicators paints a barely completely different image. The Relative Strength Index (RSI) and Chaikin Money Flow (CMF) are presently hovering in overbought territory, with RSI particularly nearing the 70 mark.

Total crypto market cap is presently at $2.677 trillion. Chart: TradingView

In less complicated phrases, this means that Ethereum’s worth at slightly above $4,000 is likely to be stretched a bit skinny and due for a possible pullback. Imagine a bounce rope competitors – for those who’re swinging too onerous and quick (like an RSI over 70), finally you’ll journey your self up.

Source: Coingecko

Ethereum’s Future: Balancing Act

Adding a layer of intrigue, the sentiment amongst buyers appears geographically divided. While the “Coinbase Premium,” a metric reflecting shopping for stress, is flourishing within the US, its Korean counterpart signifies ongoing promoting exercise.

This regional disparity might be attributed to various market dynamics and investor preferences. Perhaps American buyers, with a inexperienced Coinbase Premium, are extra optimistic in regards to the regulatory panorama surrounding crypto, whereas their Korean counterparts, with a crimson Korea Premium, are taking a extra cautious method.

So, what does this all imply for Ethereum’s future? The reply, sadly, isn’t as clear-cut as we’d like. The confluence of constructive elements like potential ETF approval, elevated community exercise with a surge in short-term holders, and a possible Bitcoin halving increase paint a bullish image.

However, technical indicators hinting at an overbought market and contrasting investor sentiment throughout areas introduce a be aware of warning. Ethereum is presently strolling a tightrope – will it keep its momentum or face a actuality test within the type of a worth correction? It’s anyone’s guess.

Featured picture from Pixabay, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You are suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site solely at your personal threat.

[ad_2]

Source link