[ad_1]

The flagship cryptocurrency, Bitcoin worth is poised for a possible surge in April, in response to insights shared by a outstanding crypto market analyst. Notably, the analyst has cited historic patterns to foretell the potential surge in BTC worth.

Meanwhile, with historic information indicating a powerful correlation between April and constructive Bitcoin returns, traders are eyeing the approaching month with anticipation amid a backdrop of market volatility and optimism.

Top Analyst Anticipates Bitcoin Rally In April

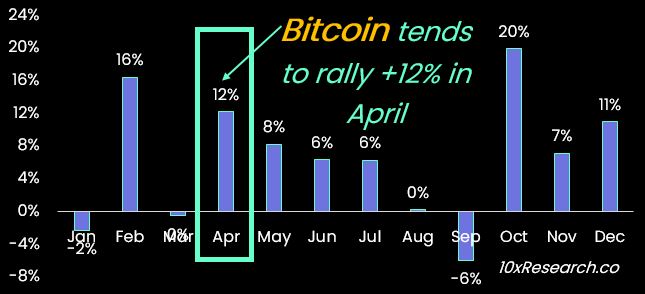

10X Research CEO Markus Thielen has lately shared an evaluation on the X platform, suggesting a possible rally in Bitcoin worth. Notably, the evaluation sheds gentle on Bitcoin’s historic efficiency in April, suggesting a possible 12% rally for the cryptocurrency.

Drawing from previous developments, Thielen highlights April’s tendency to yield constructive returns for Bitcoin, with six out of the final ten years recording notable upticks in worth. Despite current volatility within the crypto market, characterised by fluctuations in Bitcoin’s worth, analysts stay optimistic in regards to the cryptocurrency’s trajectory.

Meanwhile, a number of analysts have attributed the continued volatility in Bitcoin worth as a part of the pre-halving part. According to analysts like Rekt Capital, the pre-halving retracement phenomenon, noticed in historic information, underscores the inherent volatility surrounding Bitcoin, usually previous vital worth actions.

Moreover, the anticipation surrounding the upcoming Bitcoin Halving occasion provides to the market’s bullish sentiment. However, whereas historic information signifies an inclination for Bitcoin to rally post-halving, analysts warning in opposition to relying solely on previous efficiency to foretell future outcomes, emphasizing the unpredictable nature of the crypto market.

Also Read: VeChain Price- Top Reasons Why VeChain Is Trending

Market Confidence Boosted By ETF Inflows

Amid hypothesis over Bitcoin’s April rally, market confidence receives a lift from strong inflows into the U.S. Spot Bitcoin ETF. The rising curiosity in Bitcoin funding autos displays a broader acceptance of cryptocurrencies amongst institutional traders, additional solidifying Bitcoin’s place as a mainstream asset class.

Concurrently, the decline in outflows from Grayscale’s GBTC indicators a shift in investor sentiment, with market individuals expressing renewed confidence in Bitcoin’s long-term potential. As Bitcoin worth continues to seize the eye of each retail and institutional traders, the stage is ready for a dynamic month forward, with April probably marking one other chapter in Bitcoin’s storied

Meanwhile, as of writing, the Bitcoin price plunged 1.24% to $69,959.56, with its buying and selling quantity from yesterday dropping 27.14% to $30.87 billion. Notably, the crypto has touched a excessive of $71,546.02 and a low of $69,725.77 within the final 24 hours.

Also Read: Fetch AI (FET) Price Rally to Continue As Open Interest Points Upwards

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

[ad_2]

Source link

✓ Share: