[ad_1]

Bitcoin (BTC) has been struggling to regain its momentum as its worth stays caught beneath the $27,000 mark. This extended interval of stagnation has prompted Michael J. Kramer, a famend market strategist, to voice his apprehensions about an impending market breakdown for Bitcoin.

Taking to Twitter, Kramer shared his issues, highlighting the potential dangers and uncertainties surrounding the cryptocurrency’s worth trajectory.

As the cryptocurrency’s worth stays inert, it’s essential to look at the elements contributing to this example and delve into its implications for traders and the broader crypto panorama.

Bitcoin Price: Concerns Arise Over Potential Slide Below $20K

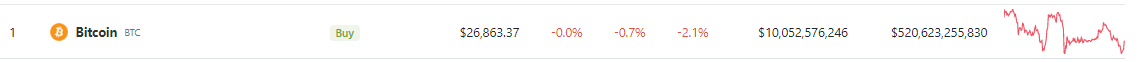

As the cryptocurrency market faces one other bout of turbulence, Bitcoin’s worth has faltered, with the present worth pegged at $26,863, in line with CoinGecko. The crypto has misplaced 2.1% of its worth within the final seven days.

In his evaluation, Kramer not solely highlights the potential for Bitcoin to succeed in the vital psychological stage of $20,000 but additionally attracts consideration to the implications such a downturn could have on the broader inventory market.

Source: Coingecko

Bitcoin serves as a barometer for different danger property, offering priceless insights into market sentiment. Should Bitcoin expertise a considerable slide beneath the $20,000 threshold, it may sign elevated danger aversion amongst traders, probably dampening confidence within the inventory market and different asset lessons.

Regulatory Uncertainty Casts Dark Clouds For Bitcoin

Just as analysts eagerly anticipated a possible breakout in Bitcoin’s worth, the cryptocurrency market took an surprising flip, descending right into a interval of decline fueled by heightened regulatory uncertainty.

Despite preliminary optimism, the prevailing macroeconomic local weather and regulatory challenges have conspired to dampen the prospects of a big worth surge within the close to time period.

Analysts had speculated that Bitcoin may expertise an inflow of funding if the United States had been to default on its debt obligations. However, this potential situation carries substantial danger, as there’s a actual chance that the US Treasury could face a scarcity of funds. The implications of such a liquidity crunch might be felt throughout the crypto area, impacting the general demand and sentiment for digital property.

BTCUSD nonetheless caught within the $26K territory. Chart: TradingView.com

Volatility Expected To Persist

Adding to the market’s woes, Democrats within the United States legislature have taken steps to solidify the Securities and Exchange Commission’s (SEC) authority over cryptocurrencies. This transfer has raised issues {that a} important variety of tokens could also be categorised as securities, probably subjecting them to stricter laws.

The prospect of elevated regulatory scrutiny looms over the crypto market, injecting a component of uncertainty and warning amongst traders and business individuals.

In gentle of those developments, the volatility that has lengthy characterised the crypto market is prone to persist.

-Featured picture from Pixabay

[ad_2]

Source link